HDFC Ergo Health Optima Restore Insurance Plan is a Comprehensive Online Health Insurance Plan that provides comprehensive cover for the entire family.

In-patient care Organ Donor Cover Pre and Post hospitalization Compare this plan with other Health Plans Show PremiumsHospitalization expenses such as room rent, nursing expenses, ICU charges, surgeon’s fees, doctor’s fees, anaesthesia, blood, oxygen, operation theater charges, etc. with no sub-limits

Day care treatment Medical expenses incurred if hospitalization is less than 24 hours for listed 140 procedures Pre and Post hospitalizationMedical expenses incurred 60 days immediately before hospitalization will be covered. Expenses incurred up to 180 days after being discharged from the hospital such as follow-up visits to medical practitioner, medication, etc will be covered

Ambulance chargesCharges of Ambulance provided by the hospital or any service provider will be reimbursed upto Rs 2000 for each hospitalization

Organ Donor CoverMedical expenses incurred by an organ donor while undergoing the organ transplant surgery if the organ is for the use of the insured person.

Domiciliary HospitalizationMedical expenses incurred by the insurer for treatment at home will be reimbursed. The medical treatment should be for a period exceeding 3 consecutive days and should merit hospitalization.

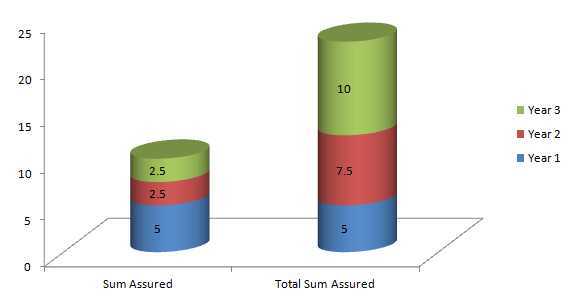

Restore of Sum AssuredIf the Sum Assured in the policy is exhausted due to claims made, then the company restores the entire sum assured once in the policy year. This restores Sum Assured amount can be used for future claims, not related to the illness / injury for which the claim has already been made during the same year.

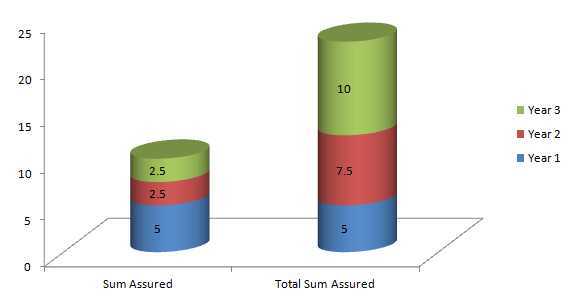

Multiplier BenefitFor a Claim Free year, there is a No Claim Bonus of 50% and another 50% of No Claim Bonus for the second consecutive Claim Free year of total 100% of Basic Sum Assured

Treatment anywhere in the countryFor select diseases / ailments / treatments, the Company will reimburse the cost of medical expenses, whether the insured gets these treatments anywhere in India.

Additional FeaturesRestore Benefit where the Sum Assured is restored if it is exhausted that can be utilized for a future claim for a different illness is made during the same policy year. Thus, if the Initial Sum Assured gets exhausted, the entire amount is restored back into the plan at no extra cost!

Multiplier BenefitMultiplier Benefit where there is a 50% increase of the Basic Sum Assured as No Claim Bonus and if the consecutive year is also Claim Free then the total No Claim Bonus increases by 100% with a net effect of Double the Basic Sum Assured

Day Care ProceduresDay Care Procedures for 140 listed day care procedures

Emergency AmbulanceEmergency Ambulance Upto Rs.2,000 per Hospitalisation

Domiciliary Treatment Organ DonorThis policy can be taken for self, spouse, dependent children and dependent parents. This policy covers all basic hospitalization expenses with the benefit of restoring the initial Basic Sum Assured if it is utilized for claim and upto 100% of Basic Sum Assured as No Claim Bonus is payable in this plan. The plan can be taken for an Individual or as a Family Floater. In a Family Floater policy, a maximum of 2 adults and a maximum of 5 children can be included in a single policy. You can opt for 1 Adult and 3 children also. The plan offer lifelong renewability. There is no claim-based loading. Also you can upgrade to the next higher slab of cover on renewal. Maternity related expenses are excluded in this plan as is the case with most plans.

There are 2 Unique Benefits in this plan:Let us explain this with an example. If you have a Sum Assured of Rs 5 lakhs and Claim for Rs 6 lakhs in the first hospitalization, then the entire limit is exhausted and only Rs 5 lakhs would be payable. However, if another claim happens within the same year for a different illness or for a different family member, then the entire Sum Assured of Rs 5 lakhs is available for claim even though the initial Sum Assured has been exhausted.

However, the restore benefit works only if:

Let us explain this with an example. If you have a 5 lakh policy and don’t claim in the first year, the cover increases to Rs 7.5 lakhs in the second year which rises to Rs 10 lakhs in the third year for another consecutive claim free year while the premium is calculated only for a premium for Rs 5 lakhs of initial Basic Sum Assured.

In case of claim, the No Claim Bonus will be reduced by 50% of the basic sum insured. However this reduction will not reduce the Sum Insured below the basic Sum Insured of the policy.

This plan provides for regular features like pre-hospitalization, hospitalization and post hospitalization expenses without any cap on charges like doctor’s fees, OT charges, etc. as well as Day Care Treatment, Domiciliary Treatment, Organ Donor costs, etc.