Written By

Kolt Legette Last Updated

Although Medicare eligibility has nothing to do with income, your premiums may be higher or lower depending on what you claim on your taxes.

Unlike Medicaid, Medicare eligibility is not based on income. However, the income you report on your taxes does play a role in determining your Medicare premiums. Beneficiaries who have higher incomes typically pay a premium surcharge for their Medicare Part B and Medicare Part D benefits. Known as the Income-Related Monthly Adjustment Amount, or IRMAA, Social Security will notify you if your income places you in this higher bracket.

Less than 5 percent of Medicare beneficiaries have to pay the IRMAA surcharge.

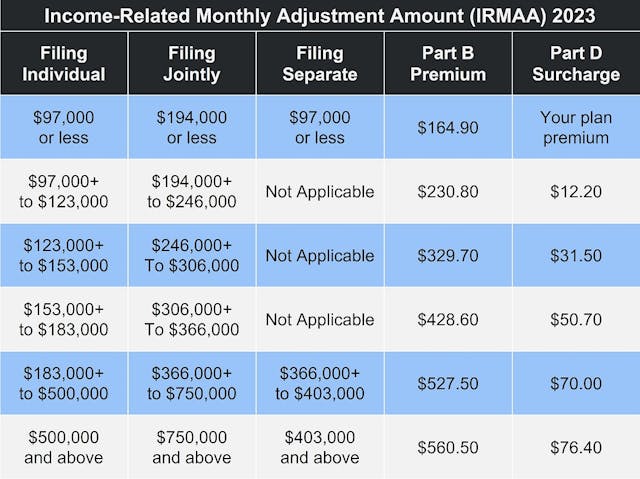

Higher-income beneficiaries face the IRMAA surcharge. In this case, "high earner" refers to anyone who claimed an income greater than $97,000 per year (filing individually OR married filing separately) or $194,000 per year (married filing jointly).

There is no premium surcharge for Medicare Part A – even if you do not qualify for premium-free Part A. If the Social Security Administration (SSA) determines you owe the adjusted amount, the surcharge is added to your Part B and Part D premiums.

Medicare Part B covers inpatient services like doctor visits and lab work. The standard monthly Part B premium in 2023 is $164.90. This accounts for around 25 percent of the monthly cost for Part B, with the government (i.e. the Medicare program) paying the remaining 75 percent. The percentage paid by high-income beneficiaries ranges between 35 and 85 percent, depending on their income as reported to the IRS.

Original Medicare (Parts A and B) does not include prescription drug coverage. These benefits are available via a Medicare Part D prescription drug plan.

As private insurance companies provide these plans, there is no set monthly premium. In this case, the IRMAA surcharge is based on a percentage of the national base beneficiary premium. That amount is then added to whatever premium you pay for your Part D plan.

High-earner Medicare Part D beneficiaries who receive Social Security benefits have the Part D IRMAA automatically deducted from their monthly stipend. This is true even if you do not normally pay your Part D premium via Social Security.

If you do not receive Social Security benefits, or the surcharge is greater than your monthly SSA payment, you will receive a bill from a different government entity. This usually means either the Centers for Medicare & Medicaid Services (CMS) or the Railroad Retirement Board (RRB).

The image below shows the adjusted amount for each income bracket.

The Social Security Administration bases the IRMAA determination on federal tax return information received from the IRS. The adjustment is calculated using your modified adjusted gross income (MAGI) from two years ago. In 2023, that means the income tax return that you filed in 2022 for tax year 2021.

If Social Security determines you have to pay higher premiums, they send you a letter detailing what your premium will be and how they arrived at their decision. If you have both Part B and Part D, you'll pay a higher premium for each. But if you only have one, you'll only owe the adjusted amount on the "part" you have. If later in the year you sign up for whichever part you don't currently have, the adjusted amount is automatically added and you will not receive a second notification.

Again, less than 5 percent of Medicare beneficiaries owe the IRMAA surcharge.

According to Investopedia, your modified adjusted gross income is "your household's adjusted gross income with any tax-exempt interest income and certain deductions added back."

Your adjusted gross income (AGI) equals your gross income minus allowable deductions, such as health savings account (HSA) contributions, retirement plan and IRA contributions, and student loan interest. To find your MAGI, you add back some of those deductions. This includes:

When determining whether you owe the Income-Related Monthly Adjustment Amount, Social Security looks at your most recent tax return. For most people, this is the return you filed the previous year, which reported your income from 2 years ago. (This can be confusing, we know. Just think of it as your most recent tax return.)

If you filed an amended tax return, contact Social Security at 1-800-772-1213 or TTY 1-800-325-0778. Representatives are available Monday through Friday from 8 AM to 7 PM. Automated services are available 24 hours a day, 7 days a week.

Income levels often fluctuate due to life-changing events, particularly once we retire. If one of the following applies to you AND it caused a permanent reduction in income, inform Social Security. (Temporary changes do not qualify as "life-changing events.")

If you experienced any of these events, complete the Medicare Income-Related Monthly Adjustment Amount Life-Changing Event form (also known as Form SSA-44). In addition, you must provide relevant documentation of the life-changing event, such as a death certificate or employer letter.

You may also appeal the IRMAA decision if you think Social Security made a mistake. You may also file your appeal in writing by completing Form SSA-561-U2, Request for Reconsideration. Just download and print the form, then follow the written instructions on how to file your appeal. Or, call Social Security at the number listed above and request a copy of Form SSA-561-U2.

Use our easy-to-use Plan Finder to find the right Medicare plan for you in your area.